CORPORATE | 07.24.2025

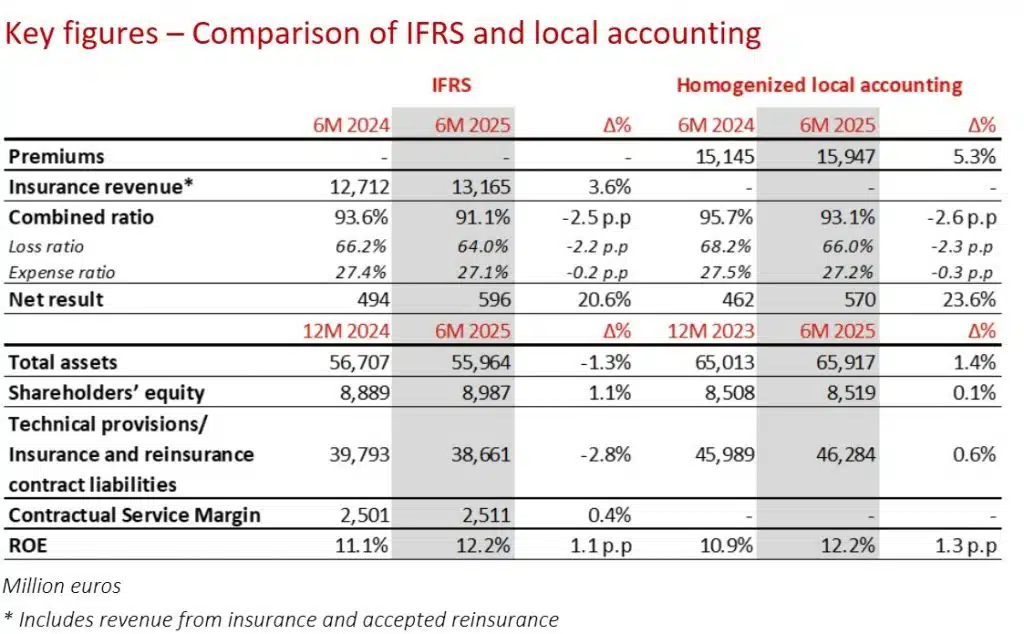

MAPFRE posts a €570 million result in June, 23.6% higher than the previous year

- Profitability continues to increase across all regions and business lines.

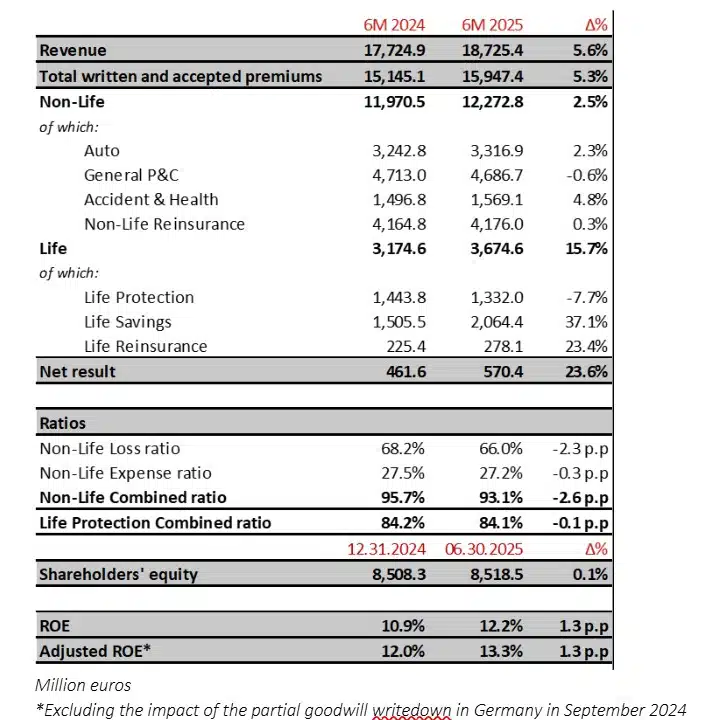

- Premiums are up 5.3% reaching almost €16 billion, with a relevant impact from currencies. At constant exchange rates, growth would reach 10.2%.

- The technical improvement in Non-Life continues, with a combined ratio of 93.1% (-2.6 p.p.), and a favorable impact from the financial result.

- The Auto business continues advancing and contributes €89 million to the result (+€108 million compared to 6M 2024).

- The ROE reaches 12.2% (13.3% excluding extraordinary items) and shareholders’ equity stands at €8.5 billion.

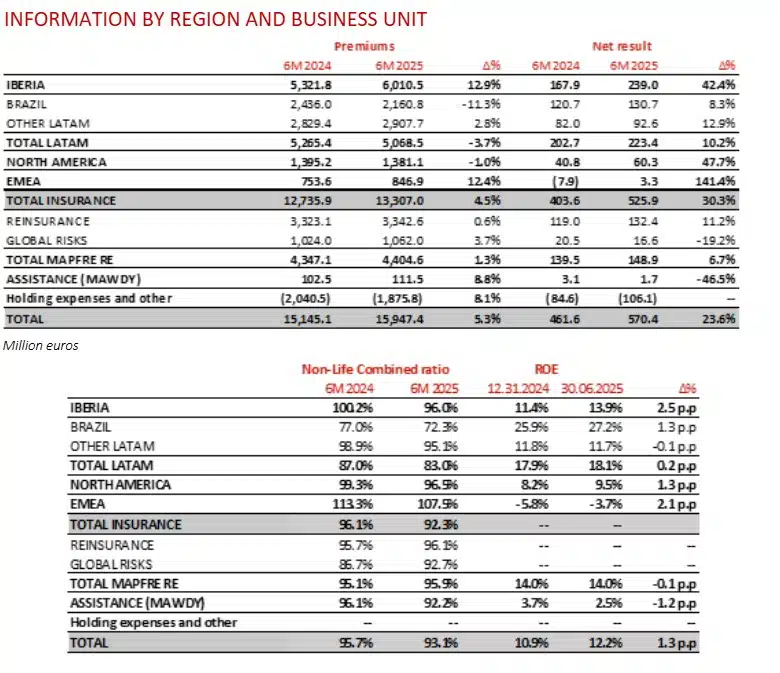

- IBERIA reports a €239 million net result (+42.4%) and a combined ratio of 96.0% (-4.2 p.p.), thanks to the relevant recovery of the Auto business.

- NORTH AMERICA continues the positive trend, with a result of €60 million (+47.7%) and a combined ratio of 96.5% (-2.8 p.p.).

- LATAM delivers €223 million (+10.2%), with a relevant contribution from BRAZIL.

- MAPFRE RE, which includes the Reinsurance and GLOBAL RISKS businesses, posts a result of €149 million (+6.7%), maintaining reserve prudence.

- Under IFRS international accounting standards, the attributable result reaches €596 million (+20.6%), the ROE stands at 12.2%, and shareholders’ equity is close to €9.0 billion.

- The Solvency II ratio remains within the target range, at 205.6% at the close of March.

“MAPFRE continues improving profitability in all regions and business units. In addition to the boost from the Strategic Plan, our highly diversified business model, along with the enormous transformation and efficiency improvements, allow us to be optimistic about 2025 despite the persistent geopolitical challenges. The depreciation of some currencies is offset by higher interest rates in many countries,” says Antonio Huertas, Chairman of MAPFRE.

MAPFRE S.A. hereby informs that, unless otherwise indicated, the figures and ratios in this activity report are presented under the accounting principles in force in each country (which generally do not apply IFRS 17 & 9), homogenized for comparison and aggregation between units and regions. As such, certain adjustments have been applied, the most relevant being: the elimination of the goodwill amortization in Spain and the elimination of catastrophic reserves in some Latin American countries. MAPFRE Group presents its financial statements under the applicable international accounting standards (IFRS). Definitions and calculation methodology for financial measures under IFRS used in this report are available at the following link: https://cbc-live.blog/media/2025-06-alternative-performance-measures.pdf%3C/span%3E%3C/span%3E%3C/a%3E%3Cspan data-contrast="auto" xml:lang="EN-US" lang="EN-US" class="TextRun EmptyTextRun SCXW249308800 BCX8">

- The depreciation of average exchange rates of main currencies compared with June 2024, particularly the Brazilian real, the US dollar, the Turkish lira and the Mexican peso, has influenced growth figures in euros.

- In the Non-Life business lines, General P&C contracts slightly (-0.6%) as a result of currency depreciation and the slowdown of the agricultural business in Brazil, offset by the positive performance in IBERIA. Accident & Health grows (+4.8%) in the majority of regions. The Auto line reflects tariff increases and is growing 2.3%.

- Regarding the Life business, premiums are up 15.7% with solid growth in IBERIA.

- The significant improvement in the Non-Life technical result, which increased 68.6% to €593 million gross, from the technical measures implemented. Furthermore, in the quarter, reserving prudence has continued to increase.

- A relevant Non-Life gross financial result of €392 million (-2.1%), slightly below last year, from currency movements.

- The high contribution of the Life business, supported by IBERIA and LATAM, with the attributable result standing at €130 million and an excellent Life Protection combined ratio (84.1%).

- The effect of hyperinflation adjustments, with a net negative impact of €16 million (€36 million in 6M 2024).

- Net realized capital gains add €32 million to results (€32 million in 6M 2024). In 2024, the first half included an extraordinary income of €25 million due to several tax adjustments.

- The Non-Life combined ratio improves 2.6 p.p. to 93.1%. The loss ratio is down 2.3 p.p. to 66.0%, sustained by profitable growth, tariff adjustments and other technical measures. At the same time, the expense ratio is down 0.3 p.p. to 27.2%, thanks to a strict cost containment policy.

- In Auto, the combined ratio strengthens 5.1 p.p. to 99.6%, with significant reductions in most regions. General P&C maintains an excellent 81.2% (-2.1 p.p.), while the Accident & Health ratio stands at 95.8% (-5.8 p.p.).

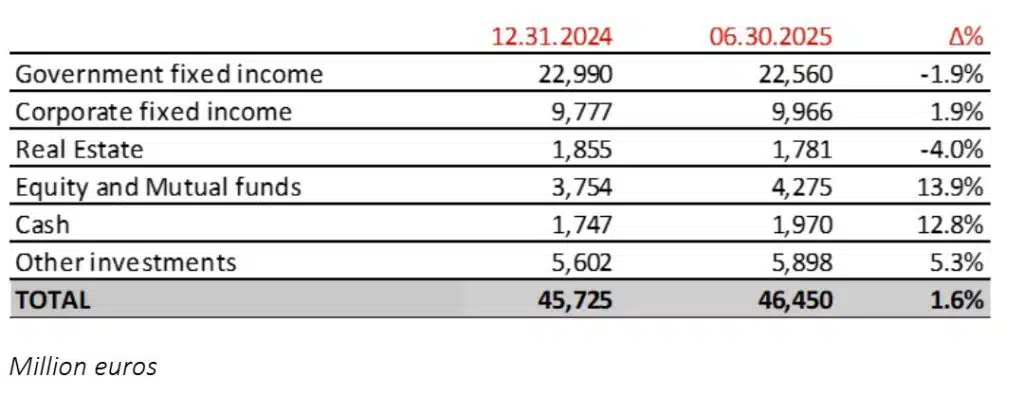

- Shareholders’ equity amounts to €8.5 billion (+0.1% during the year) due to the retained earnings and the improved valuation of the available for sale portfolio which have offset the negative currency conversion differences, mainly from the US dollar that has depreciated 11.8% in the year.

- The investment portfolio is shown below:

- Premiums in IBERIA reach €6.0 billion (+12.9%), with Spain contributing more than €5.8 billion (+14.3%). In Portugal, premiums are down 15.8% reaching €205 million, due to the exceptional Life issuing in 2024.

- Non-Life premiums increase 4.7%, reflecting positive developments in most businesses. General P&C advances (+5.8%), supported by all lines of business, with noteworthy growth in Commercial lines. The performance in Auto (+3.7%) shows the improvement in technical management.

- Regarding the Non-Life combined ratio, down 4.2 p.p. to 96.0%:

- The Auto combined ratio improves substantially, reaching 98.4% (-7.7 p.p.) as a result of the technical measures implemented.

- Accident & Health reduces its ratio to an excellent 93.3% (-9.7 p.p.).

- General P&C posts a combined ratio of 95.3% (+0.4 p.p.).

- Life premiums grow significantly (+34.4%) due to excellent issuance in Savings products, while Life Protection grows 1.2%. The life business adds €60 million to results with a large contribution from the Life Protection business, which had a combined ratio of 67.8% (-0.1 p.p.).

- Profitability of the investment portfolio continues to contribute positively to the financial result. Net realized financial gains were €25 million (€33 million in 6M 2024).

- Net profit stands at €239 million (+42.4%), with Spain and Portugal reporting €235 and €4 million, respectively.

LATAM contributes significantly to earnings with €223 million (+10.2%)

BRAZIL records a ROE over 27% with improved technical ratios and high investment returns

- In Brazil, premiums reach nearly €2.2 billion (-11.3%), significantly affected by the depreciation of the Brazilian real (-11.6%). In local currency, business volume is relatively stable (+0.4%). The Life and Agro lines are affected by the geopolitical and macroeconomic situation, as well as by the uptick in interest rates, which slows down issuing in credit-linked insurance products. On the other hand, certain General P&C lines, like Multirisk, both in retail and corporate clients, have noteworthy growth.

- The Non-Life combined ratio maintains an excellent level of 72.3% (-4.6 p.p.). General P&C reports a ratio of 63.4% (-5.2 p.p.), supported by the Agro business. The Auto combined ratio stands at 101.8% (+0.3 p.p.).

- The increase in interest rates is still being reflected in the Non-Life financial result, which is offset by currency depreciation.

- The Life Protection business continues being very profitable with a combined ratio of 81.8% (-0.5 p.p).

- The net result stands at €131 million (+8.3%).

- Premiums are up 2.8% in euros, with local currency growth in almost all markets.

- The combined ratio improves to 95.1% (-3.8 p.p.), with favorable developments in almost all lines, especially General P&C and Auto.

- Financial income and the Life business continue contributing positively, despite the impact of currency depreciation.

- In Mexico, premiums are up 24.4% in local currency. In euros, premiums reach over €1.1 billion (+5.5%), with the depreciation of the peso (-15.2%). Both Life (+37.9%) as well as the Accident & Health line (+8.1%) have experienced strong growth. The combined ratio improves to 95.5% (-2.8 p.p.) and the net result reaches €25 million (-4.7%).

- In Peru, premiums grow 9.3% in local currency. In euros, premiums reach €427 million (+11.0%). The combined ratio improves to 95.3% (-2.6 p.p.) while the result stands at €24 million (-4.7%).

- In Colombia, premiums are up 11.1% in local currency. In euros, premiums stand at €281 million (+3.1%). The combined ratio stands at an excellent level of 88.6% (-8.1 p.p.) and the result increases to €20 million (+7.1%).

- Hyperinflation adjustments, mainly from Argentina, had a €6 million negative impact on attributable results (below the €27 million in 6M 2024).

NORTH AMERICA increases its result to €60 million (+47.7%) with a combined ratio of 96.5%

- Premiums reach close to €1.4 billion (-1.0% in euros), impacted by the depreciation of the dollar (-1.8%). In local currency, premiums grow 0.8%.

- The Non-Life combined ratio progresses to 96.5% (-2.8 p.p.), thanks to the significant tariff adjustments and other technical measures implemented in recent years. The Auto combined ratio continues improving, reaching 97.5% (-3.5 p.p.), while in General P&C, the combined ratio maintains its positive trend, reaching 88.9% (-0.9 p.p.).

- The United States contributes nearly €1.2 billion in premiums and a result of €52 million.

- In Puerto Rico, premiums and results stand at €221 and €8 million respectively.

EMEA posts positive numbers with a significant improvement in the German business

- Premiums stand at €847 million (+12.4% in euros), with notable growth in the majority of markets.

- The region posts a positive result of €3 million (-€8 million in 6M 2024), with improvements in Germany and Italy, which offset the impact of the depreciation of the Turkish lira (-24.8%).

- Turkey and Malta continue to contribute to the results while Germany and Italy significantly reduce their losses, bringing the combined ratio down from 113.3% to 107.5%, due to the relevant improvement in Germany.

MAPFRE RE contributes €149 million to the result (+6.7%)

- Premiums reach €4.4 billion (+1.3%), impacted by currency depreciation, mainly the US dollar. This includes the Reinsurance business, with over €3.3 billion (+0.6%) in premiums, and the GLOBAL RISKS business, with €1.1 billion (+3.7%).

- The combined ratio stands at an excellent 95.9% (+0.7 p.p.) and reserving prudence has continued to be strengthened. The most relevant event was the California wildfires in the first quarter, with an attributable impact of €84 million.

- The gross financial result contributes €91 million and €6 million in net realized financial gains (-€1 million in 6M 2024).

- The attributable result stands at €149 million, of which Reinsurance reports a net profit of €132 million with a combined ratio of 96.1%. The GLOBAL RISKS business delivers €17 million to the Group result with a combined ratio of 92.7%.

MAWDY consolidates its positive contribution to the Group earnings